The domestic scrap market has started the New Year with a bang! Ferrous and non-ferrous markets have skyrocketed with consumers, both domestically and abroad, fighting to secure materials. Ferrous grades are up $60 – $100 per gross ton from December ’20 to January ’21 and non-ferrous prices have also continued to trend upward. So what’s driving the market? One word, Demand.

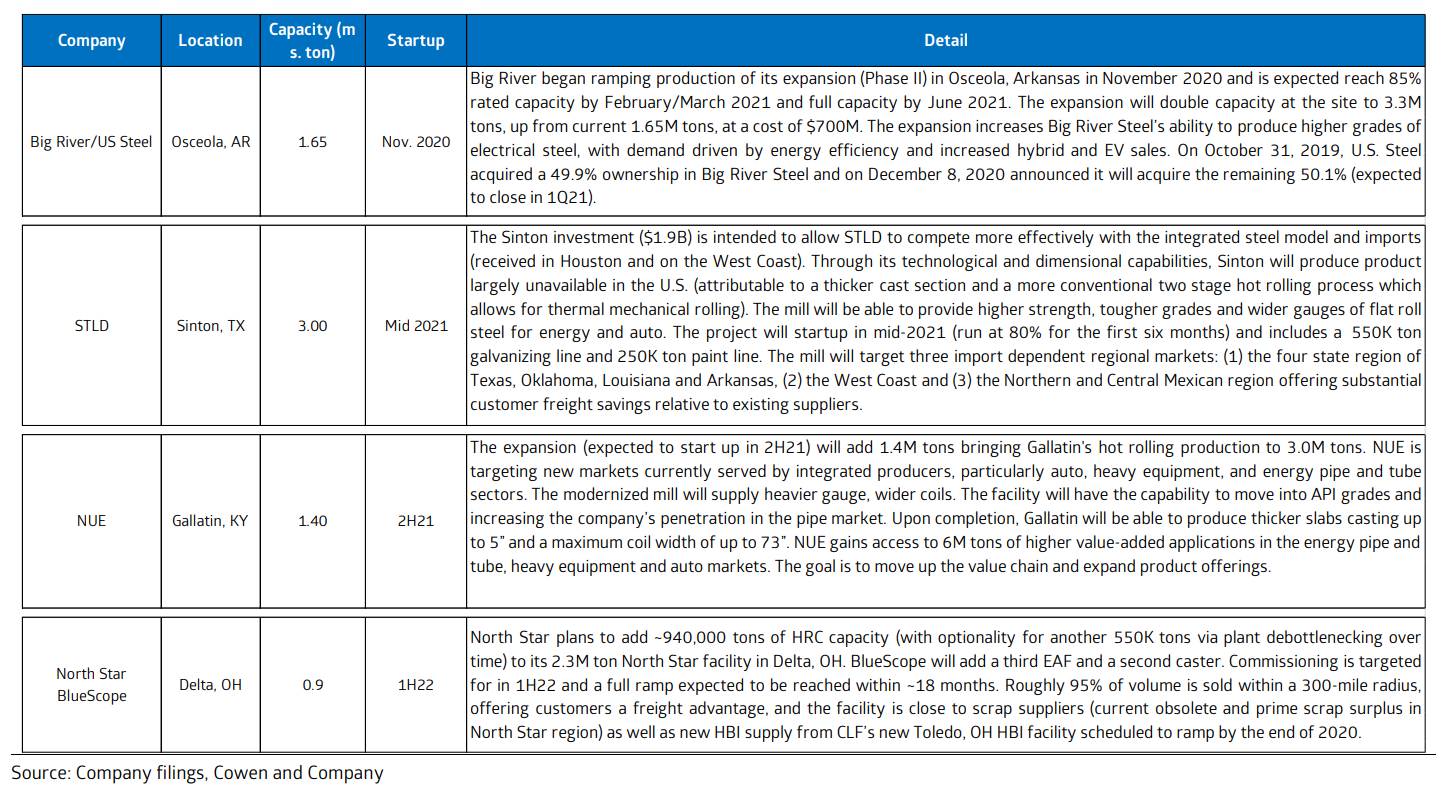

First, 7M tons of new Electric-Arc Furnace (EAF) sheet capacity is expected to ramp up in ‘21 and ‘22. The domestic steel industry is in the midst as new technology advances and older high cost Blast Furnace (BOF) capacity exits. The transition to EAFs will add additional demand for ferrous scrap metals as EAFs use 75% – 100% recycled scrap metal in their production contrary to BOFs that only use 25% recycled materials. The 7M tons of new capacity includes Big River Phase II (1.65 M tons in Nov ’20), STLD’s Sinton, TX greenfield (3M tons in 2H21), NUE’s Gallatin, KY expansion (1.4M tons in 2H21) and North Star BlueScope’s Delta, OH expansion (1M tons in 1H22).

Next, China ended the ban on imports of ferrous scrap on January 1, 2021. The new policy replaces previous regulations on the restricted imports of ferrous scrap since July 2019. Products under the following HS codes 7204100010, 7204210010, 7204290010, 7204410010, 7204490030 are refined as “resources” and the 2019 tariff barrier has been completely removed. It appears this new policy was implemented to support increased EAF steel making capacity. A report from the Davis Index indicates China will import 1M tons of ferrous scrap in 2021.

The US non-ferrous scrap market also continues to trend upward due to strong demand, tight supply, and the robust manufacturing base. Historically, consumer demand picks up in January due to reduced year-end inventories and January 2021 has followed the historic trend. It is being coupled with seasonal and public health factors that are placing limits on the amount of scrap flowing into scrap yards. “The forecast for the first quarter of 2021 is bullish,” states George O’Brien, Director on Non-Ferrous. “We’ve experience drastic increases in scrap prices and demand and unless we’re faced with a new pandemic or the new administration shuts us down, I don’t foresee demand softening in the short-term.”

By the end of 2020 most non-ferrous prices had rebounded after being pushed to their lowest levels in the first quarter of 2020. Most prices on the London Metal Exchange rebounded back to multi-year highs. Comparing the LME’s January 3, 2020 open to December 31, 2020 close, Copper increased 25%, Nickel increased 17%, Zinc increased 18%, Aluminum increased 11%, Lead increased 4% and Tin increased 20%. Aluminum and Lead took big hits due to the global shutdown of many automotive producers. Zinc had one of the larger deficits of the metals, partially due to Covid, but also mine disruptions, especially in Gamsberg, which is still shut down to this day. Popular demand of electric vehicles has kept Nickel on a steady uptrend even through the pandemic. Nickel and its by-product Nickel sulfate are key components in the lithium batteries used for these vehicles. Copper and Tin take the cake on their 2020 performances. Production and manufacturing of smart phones, laptops, and TVs were a main driver in Tins performance do their their crucial electronic chips. Copper rallied the most once China opened back up, importing 5.6M tons, up 41.1% since a year ago and hitting milestone records of cash price on LME since 2013. All metals and industries had their fair share of challenges due to the Covid pandemic, however, it’s clear which metals outperformed the others.

Are you looking for a competitive supply chain solution? Contact us to learn more about our subsidiary, BL Duke River Terminal. Their services include stevedoring, transloading, warehousing, and final mile delivery.