Temperatures may be cooling down, but scrap metal demand is heating up. A healthy appetite for scrap metal was met with tight inventories this month, and the expectation is that US ferrous scrap prices will continue to rise over the next 90 days.

Chicago’s Ferrous Scrap Metal Market

November’s ferrous trade quickly became a seller’s market, with prices increasing $10 – $30 per gross ton in Chicago. A tentative resolution of the UAW strike, fewer steel mill maintenance outages, HRC price hikes, surprisingly robust export activity, and the reopening of the Illinois River have bolstered scrap prices. In Chicago, prime grades increased $30 per gross ton compared to October, and cut grades improved by $10 – $20 per gross ton.

Since the Illinois River reopened on October 1st, scrap dealers with access to barge transport have capitalized on demand and higher prices outside Chicago’s region. Access to trade on the river corrects the oversupply of scrap in Chicago and strengthens local scrap prices. During the 120-river closure, prices for prime grades dropped by nearly 30% in Chicago and have bounced back 8% since the reopening.

“The reopening of the Illinois River allows scrap to leave the region efficiently,” states Lou Plucinski, President. “This has a direct effect on supply and scrap prices in Chicago.”

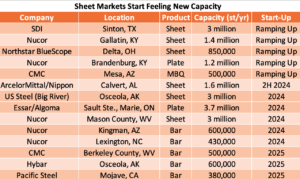

The appetite for ferrous scrap shows no signs of slowing down due to new Electric Arc Furnace (EAF) capacity. There is a surge in demand for scrap metal in 2024, primarily due to Nucor, US Steel/Big River and Essar/Algoma collectively requiring substantial 9.59 million tonnes of scrap metal and more than 22 million tonnes of additional scrap metal material are needed in less than a decade.

Chicago’s Non-Ferrous Scrap Metal Market

Non-ferrous metal prices are trading sideways month to month, both domestically and overseas. There is little chance for base metal prices to improve this month and for that matter, the balance of 2023. Most of the same factors continue to loom and contribute to the lackluster performance of non-ferrous metal prices and demand. Weak economic growth in China, the fear of a global recession, the conflict in the Middle East, along with high interest rates are keeping non-ferrous metal prices depressed.

There is a silver lining, all six LME base metals (Copper, Nickel, Aluminum, Zinc, Lead, and Uranium) posted slightly higher prices during the first few trading days of November. These increases came on the cusp of data released November 3rd indicating a healthy U.S. job market and the Fed decided against increasing interest rates on November 1st. This eased the U.S. dollar  from its highest level this year giving metal prices a slight boost. While this news is welcome and hopefully something that can be built upon heading into 2024, scrap metal prices are not acknowledging the slight increases in trading market. Stainless steel prices are holding firm with no signs of life in the market. Typically, November and December are short months because of holiday shutdowns. Mills traditionally reduce their output and implement strict inventory controls which has a major impact on their need for scrap.

from its highest level this year giving metal prices a slight boost. While this news is welcome and hopefully something that can be built upon heading into 2024, scrap metal prices are not acknowledging the slight increases in trading market. Stainless steel prices are holding firm with no signs of life in the market. Typically, November and December are short months because of holiday shutdowns. Mills traditionally reduce their output and implement strict inventory controls which has a major impact on their need for scrap.

A recent poll indicates Copper Prices are expected to see a modest recovery in 2024 despite facing a litany of headwinds. A projected increase in demand from the Chinese energy sector should outweigh the struggles of its property market. Currently, copper prices have traded up 1.6% this month on the news. If this upward trend can continue for the balance of 2023, buyers of all grades of copper and brass will have no choice but to recognize the increase and begin to pay more for scrap metal.

Thanks to your continued support, BL Duke celebrated our 23rd anniversary last month. Here is a snapshot of how we’ve grown.