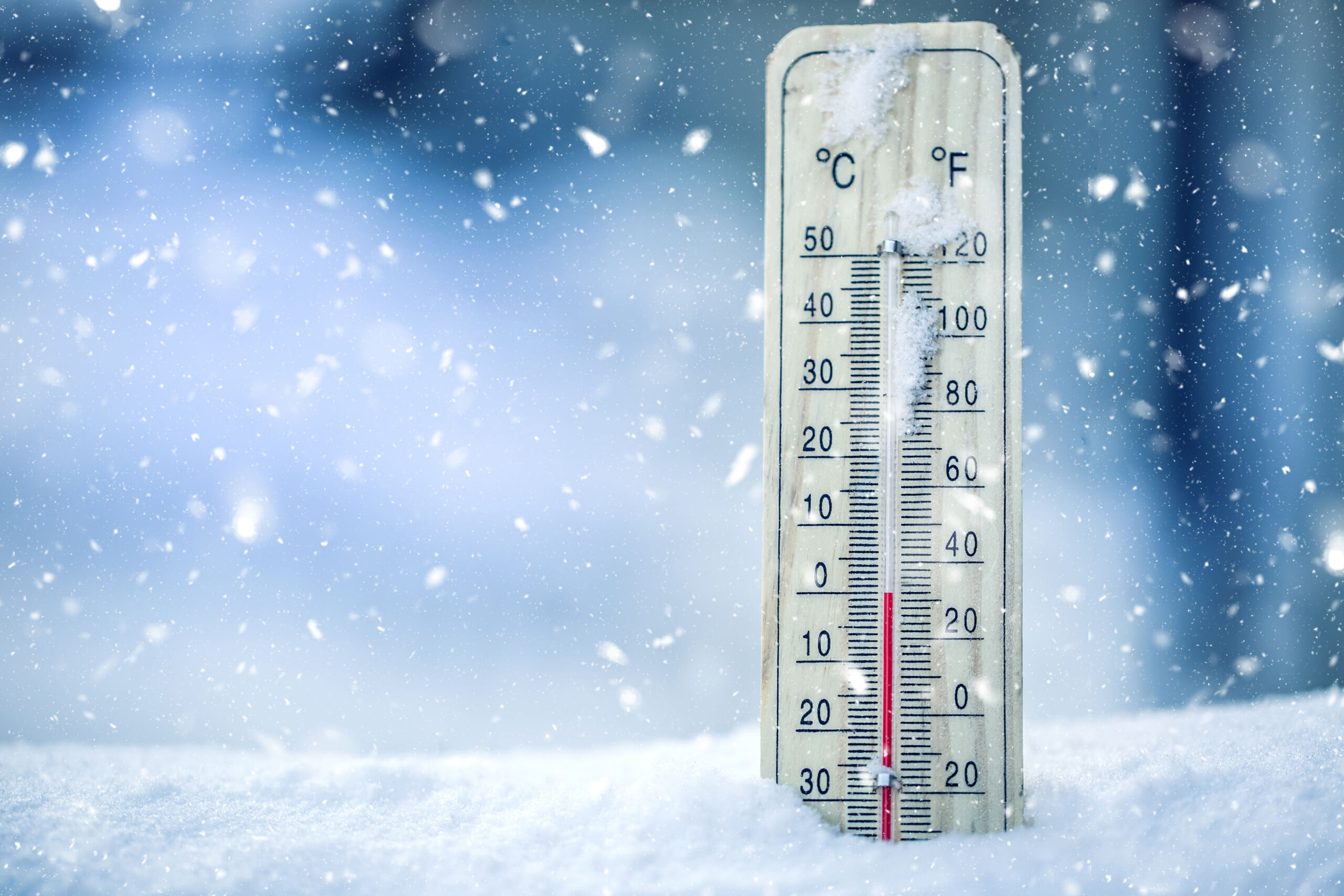

Scrap buyers took down the market on the heels of lower finished steel prices and shorter lead times. Stable export prices and January’s cold snap, however, limited the downside of ferrous scrap metal prices across the US.

Chicago’s Ferrous Scrap Metal Market

Scrap negotiations froze as February’s trade kicked off in Chicago. Scrap dealers were met with canceled orders and limited demand, that suppressed February’s scrap market. Prime grades took the largest hit at down $30 per gross while cut grades decreased $10 – $15 per gross compared to January. Shredded scrap was sideways in Chicago, with winter weather impeding shredder feed flows.

January’s cold snap disrupted scrap metal movement in Chicago from January 12th – January 19th. Limited scrap metal was delivered to dealers’ yards or to steel mills in the Midwest, Great Lakes, and the Ohio and Tennessee Valleys for the entire week.

“I would like to thank our recycling partners for their patience as we worked through last month’s polar vortex,” states Ron Antos, Dispatch Manager. “Mother nature challenged us with snow and freezing temperatures, making it challenging to safely dispatch 100 trucks.”

Chicago’s Non-Ferrous Scrap Metal Market

Copper prices retreated and fell to their lowest level in nearly two weeks due to the US dollar showing signs of strength and to no signals of US rate cut in March. Although tighter supply and positive data from top consumer China have lent some support, the troubled Chinese property sector is still a concern. However, copper, used in power and construction, is likely to find a price floor quickly as rising investment in the power grid in China helps to offset the country’s sluggish property sector. The trend is upwards for the next couple of months. A private-sector survey showed that China’s factory activity expanded in January and new export orders registered the first rise since June.

helps to offset the country’s sluggish property sector. The trend is upwards for the next couple of months. A private-sector survey showed that China’s factory activity expanded in January and new export orders registered the first rise since June.

Aluminum scrap prices remained stable the first few days of the month and are expected to rise against a strong domestic mill and smelter demand, a healthy export appetite, and a rising LME Aluminum price.

Meanwhile, stainless steel scrap prices are inching up and not following the declining LME nickel price. The nickel market which has continued to fall, is now down 4.5% from the first of the year and is fast approaching the $7.00/lb. mark. A horrible winter along with a slowdown in in demand from the manufacturing sector has caused stainless steel scrap to flow slower than usual into dealer yards. Mill order books are improving, and so is their need for scrap, which is causing prices for 300 series stainless steel to rise against a declining nickel price.