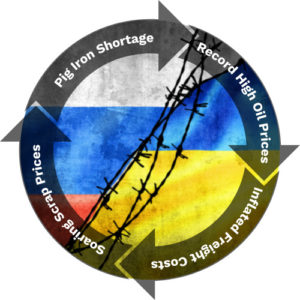

Midwest ferrous scrap prices were forecasted to increase in March due to adverse weather conditions, infrastructure demands and new domestic EAF capacity. Add a pinch of robust exports and you get a market you can believe in! The Russian invasion of Ukraine changed the game. The LME and COMEX shot non-ferrous scrap prices to record highs forcing the LME to suspend nickel trading and pig iron uncertainties drove Midwest Futures in April and May to $750 per gross ton, the highest since the 2008 spike.

Record breaking price gains were realized in Chicago. No. 1 Busheling and Bundles increased $190 per gross ton, the largest one month increase to date. Cut cut grades jumped $125 per gross ton and steel turnings are now up $100 per gross ton.

“No one knows how long the unrest in Eastern Europe will continue,” states Lou Plucinski, President. “Its impact on our domestic scrap market is undeniable. It’s likely the next few months will be extremely volatile. We are laser focused on inventory management and our commitments to our mill customers.”

The situation between Russia and the Ukraine has caused extreme volatility for non-ferrous scrap markets. The LME suspended nickel trading on March 8th through March 11th, after prices doubled to more than $100,000 per tonne. Comex Copper traded at an all time high on March 7th approaching $5.00/lb. It has since corrected, trading down $0.40/lb on March 9th. The aluminum scrap market is on the same roller coaster as the copper market and dropped $0.12/lb on March 9th alone. Many non-ferrous consumers have retreated to the sidelines, waiting to see how markets react when Nickel trading resumes.

Pig Iron

The demand and prices for prime grades of scrap metal soared when Russia’s invasion of Ukraine disrupted pig iron supply chains. The US primarily imports pig iron from Russia, Ukraine, and Brazil and pig iron’s main scrap substitute is No. 1 Busheling. More than 60% of imported pig iron in 2021 came from the Black Sea region. US steel mills dependent on pig iron imports are scrambling and forced to pay higher prices for the tight domestic supply of scrap. Demand for prime grades are forecasted to increase as the US is also on track to add just under 8.2mm short tons/year of new melting capacity in 2022.

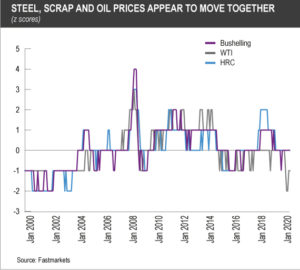

Oil prices are said to have a very close relationship with the prices of ferrous scrap metal. Over the period from the beginning of 2000 into the the first half of 2020 busheling and oil prices have moved together 84% of the time. Gas prices are at an all time high, up $0.71 since the beginning of the invasion, and we anticipate they will increase after President Joe Biden’s announcement that his administration is banning Russia’s oil, natural gas and coal imports to the US.

“Higher fuel cost will only add to the trucking and equipment expenses that are plaguing our industry,” states Ron Antos, Dispatch Manager. “We are adding to our fleet to ensure our manufacturing and mill customers are serviced.”

The international scrap shortage caused by conflicts between Russia and Ukraine has kicked export into gear, with Turkey purchasing multiple deep-sea cargoes. Circumstances between Russia and Ukraine have completely halted their billet production and turning most Black Sea customers to Turkey. More deep-sea scrap cargoes were booked into early March to keep up with the increased demand in the Black Sea area. Turkish mills are already selling material into May, but are asking for increased prices for March and April orders due to the unprecedented demand.

Our thoughts and prayers are with the people of Ukraine. Glory to Ukraine.