Chicago’s Ferrous Scrap Metal Market

After five consecutive months of falling prices, Chicago’s ferrous scrap market has begun to feel like Groundhog Day. US steel mills succeeded at securing September’s tons at a $10 – $25 per gross ton discount compared to August. The bearish sentiment was driven by a combination of 10 steel mill maintenance outages and sluggish export markets. Non-ferrous scrap markets are also being challenged by inflation, soaring energy costs, and transportation bottlenecks.

Since March’s peak, No. 1 Bundles reached $690 per gross ton and have now fallen by 43 percent to $390 per gross ton. Machine Shop Turnings peaked at $350 per gross ton and have plummeted a whopping 81 percent to $65 per gross ton, the lowest price since April 2009.

“Mills have continuously pushed down scrap prices even in light of recent increases to finished steel prices. This makes me skeptical of the actual cause and effect,” says Lou Plucinski, President. “It feels a bit like Groundhog Day.”

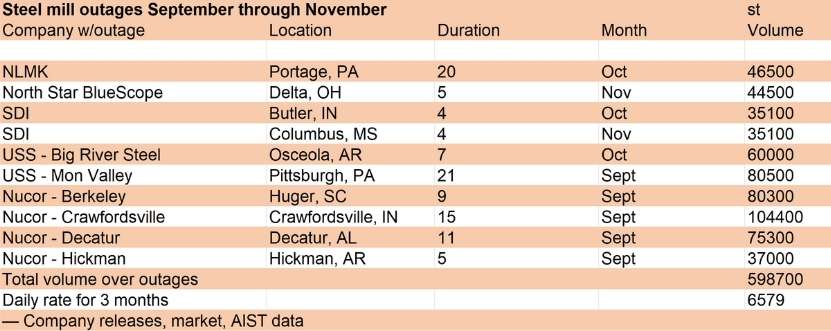

Steel mill outages weakened overall ferrous scrap demand. The 10 scheduled outages, mainly for maintenance, will take out nearly 600,000 short tons of flat-rolled production through the end of the year. For the week ending September 3, 2022, raw steel production was 1,715,000 net tons while the capacity utilization rate was 77.9 percent. The decrease would average out to approximately 6,450st/day from September through November based on the mills’ rated capacity.

US scrap export prices are being weighed down by Turkish mills’ price drops. Turkey, the world’s leading scrap importer, plays a major role in determining scrap prices in the global market. Turkey has kept scrap imports to a minimum over the past few weeks as a result of soft steel sales, the value of the US dollar, and spiking energy costs.

Chicago’s Non-Ferrous Scrap Market

Aluminum and stainless steel scrap metal prices seem to have stabilized as the first full week of business in September ended. Primary aluminum consumers are actively purchasing material but have pushed delivery appointments out 45 – 60 days. While secondary aluminum consumers, who buy casting aluminum alloys and scrap aluminum turnings, are only in business when purchasing specific alloys.

“The good news is any sales made for the desired secondary aluminum alloys are accompanied by prompt delivery appointments,” states George O’Brien, Director of Non-Ferrous.

Stainless steel mills continues to buy quietly, with unchanged month to month. However, the bearish sentiment shared by LME nickel traders and stainless steel mills continue to loom over the market.

Copper and brass scrap metal prices experienced their best weekly gain in six weeks. The gains are supported by a weaker US dollar and lower-than-expected inflation numbers out of China. Traders are concerned copper cannot sustain a rally as the performance of red metals is directly correlated to the global economy.

Do you plan on attending any upcoming events? Let’s schedule a meet-up. Here’s where you’ll find the BL Duke Team, Upcoming Events 2022.