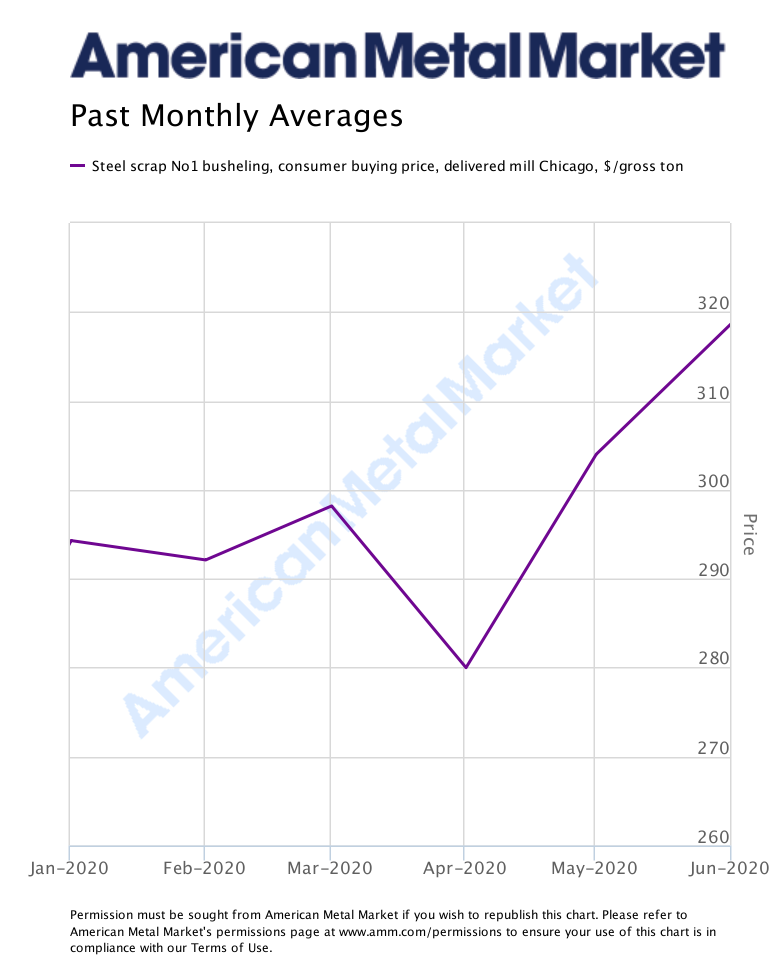

Entering 2020, what everyone thought was light at the end of the tunnel, was really an oncoming train. No one could have predicted the impact Covid-19 would have on the metals industry. We were looking forward to a less volatile scrap market and were preparing for the Illinois River Closure and the downward pressure that would add to the scrap market. We were blindsided however with how Covid-19 would impact our business, community and life as we knew it. Here’s a look back at the first half of 2020 scrap market:

June 2020| The US ferrous scrap market was quick to settle for June with prime grades increasing $10 per gross ton and cuts grades keeping steady at May’s levels. With automotive running at 25 – 40%, primes grades remained in tight supply. Both coasts also enjoyed a renewed demand in the ferrous scrap export market.

May 2020| May’s US Ferrous Scrap Market rebounded and recouped some of April’s losses. Prices in the Chicago region increased $30/gt on cut grades and $40/gt for steel turnings and prime grades of scrap metal. While Chicago mills were not busy, the drop off in supply exceeded the drop off in orders. Prime scrap was in tight supply and was not replaced due to the continued shutdown in the Detroit automotive region.

Source: Fastmarkets AMM

April 2020| The US ferrous scrap market settled with pricing plummeting $30 to $50 per gross ton. Weak demand due to mills suspending or reducing operations did not exceed the significant scrap shortage. Many scrap dealers sat out in April as their inflows dropped by 50-80%. Steel mills, however, did not budge on lower offers in the face of falling finished steel prices and reduced order books that will force them to drain their inventories. The American Metal Market’s Consumer Buying Prices were delayed to post this month due to a historically late start to scrap sales and very few reported deals. The Covid-19 pandemic and government shutdown also impacted nonferrous markets. Mills and smelters have cut production and idled furnaces across the country causing decreased non-ferrous scrap values.

March 2020|Steel mills widened the gap between prime and cut grades in March. Prime grades increased $10/gt and cut and turning grades remained at February’s levels. There was still much demand in the Chicago area, however, the uncertainty of Covid-19 had mills and dealers buying and selling cautiously.The nonferrous markets also felt the impact of Covid-19. With the plummeting stock market, aluminum, copper, and stainless steel markets traded downward. Domestic supply and demand for nonferrous metals was in balance, at least for the short term, but prices have deteriorated impacting copper prices by over 25%.

February 2020| The scrap industry is not feeling the love in February. Despite strong local demand, ferrous scrap prices dropped as a result of weak export and oversupply in southern markets. In Chicago prices are down $10 – $30 per gross ton compared to January’s levels.

January 2020| The 2020 ferrous scrap market started to recovery after 2019’s dismal performance. January’s scarp prices are up $30 – $40 per gross ton compared to December. Key reasons for the increase are: Mill outages have ended; export is strong and scrap supply and demand are more in balance.

As we entered 2020 nonferrous projections were mixed. Copper gained some strength as 2019 came to an end due to progress in the trade negotiations with China and the strengthening of the stock market. Stainless steel mill demand was fairly strong, and product was easy to move. In the case of the aluminum, mill and secondary smelter demand improved but deliveries are out