During the first week of each month, referred to as "The Buy," our team negotiates with steel mills to secure purchase orders for all ferrous grades. The remaining three weeks are then focused on fulfilling these orders. Various factors, including supply and demand, mill outages, export demand, weather conditions, and the availability of freight and cost, impact these negotiations. At BL Duke, we prioritize shipping point pricing and take full advantage of our ability to ship materials via truck, rail, and barge.

As we move into September, the domestic ferrous scrap market is showing its first signs of softening since spring. Prime grades and shred are forecasted to fall $20 per gross ton, while cut grades are expected to hold steady at August's pricing. Several factors are shaping this month's outlook, from mill buying behavior to trade policy shifts and scheduled outages.

Mill Demand

Domestic steel mills have scaled back buy programs heading into September. This reduction in demand is putting downward pressure on pricing, particularly for prime grades and shred.

Tariff Expansion

On August 18, 2025, the U.S. government enacted a 50% tariff expansion on 407 steel and aluminum product codes. The scope is wide, covering:

-

Auto parts

-

Transformers

-

HVAC equipment

-

Aluminum wire

-

Fasteners

-

Household appliances

These tariffs are reshaping import economics, potentially impacting both domestic supply chains and global demand flows.

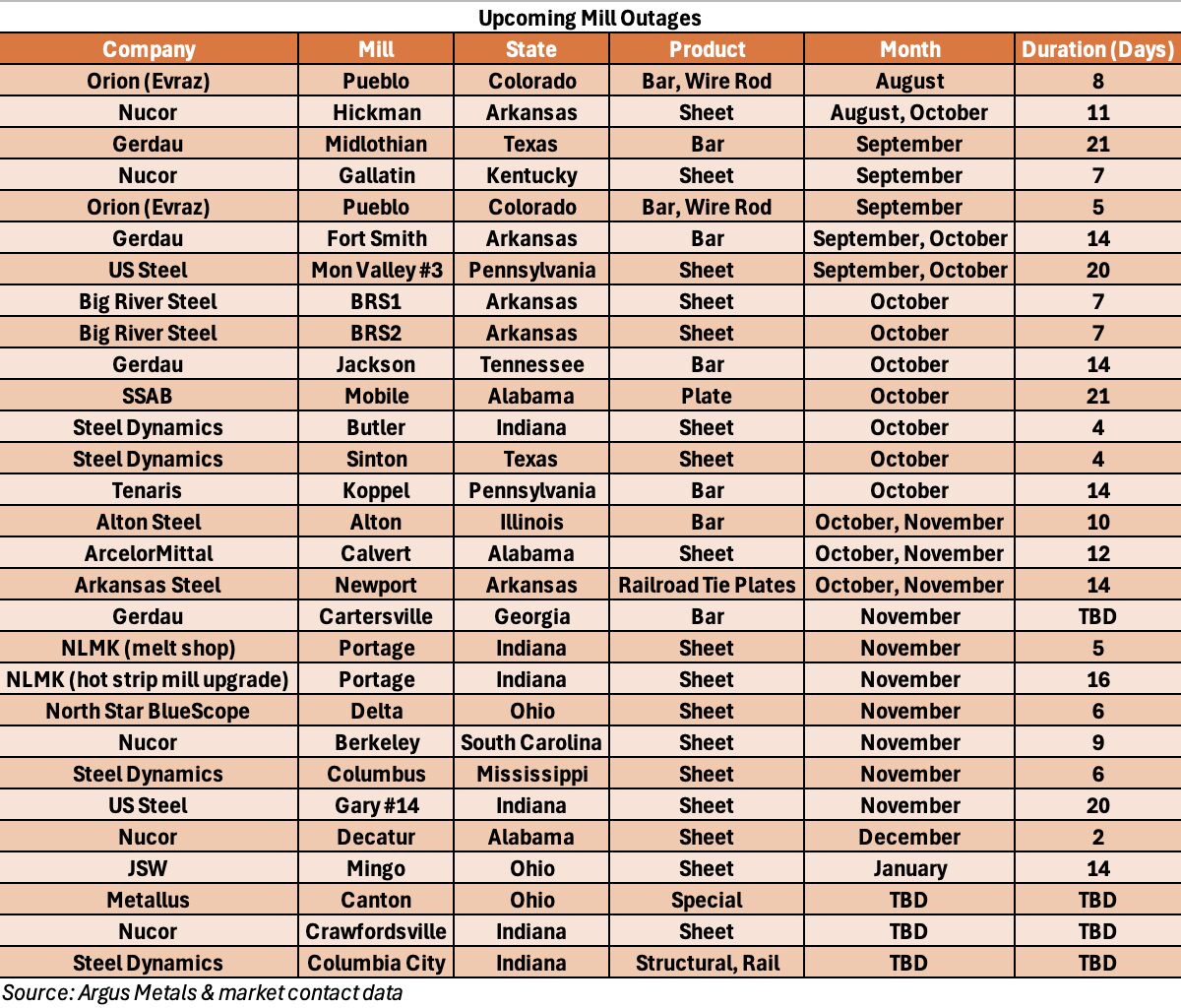

Mill Outages

Adding another layer of complexity, multiple mill outages are scheduled over the coming months. While these outages may temporarily tighten supply, they also reduce immediate scrap demand, creating short-term volatility in pricing.

Want to know how this outlook impacts your scrap program?

Contact the BL Duke team to schedule a meeting—or meet us in Hall D, Booth #D37335 at FABTECH (Sept 8–11, McCormick Place) to learn more in person.