During the first week of each month, referred to as “The Buy,” our team negotiates with steel mills to secure purchase orders for all ferrous grades. The remaining three weeks are then focused on fulfilling these orders. Various factors, including supply and demand, mill outages, export demand, weather conditions, and the availability of freight and cost, impact these negotiations. At BL Duke, we prioritize shipping point pricing and take full advantage of our ability to ship materials via truck, rail, and barge.

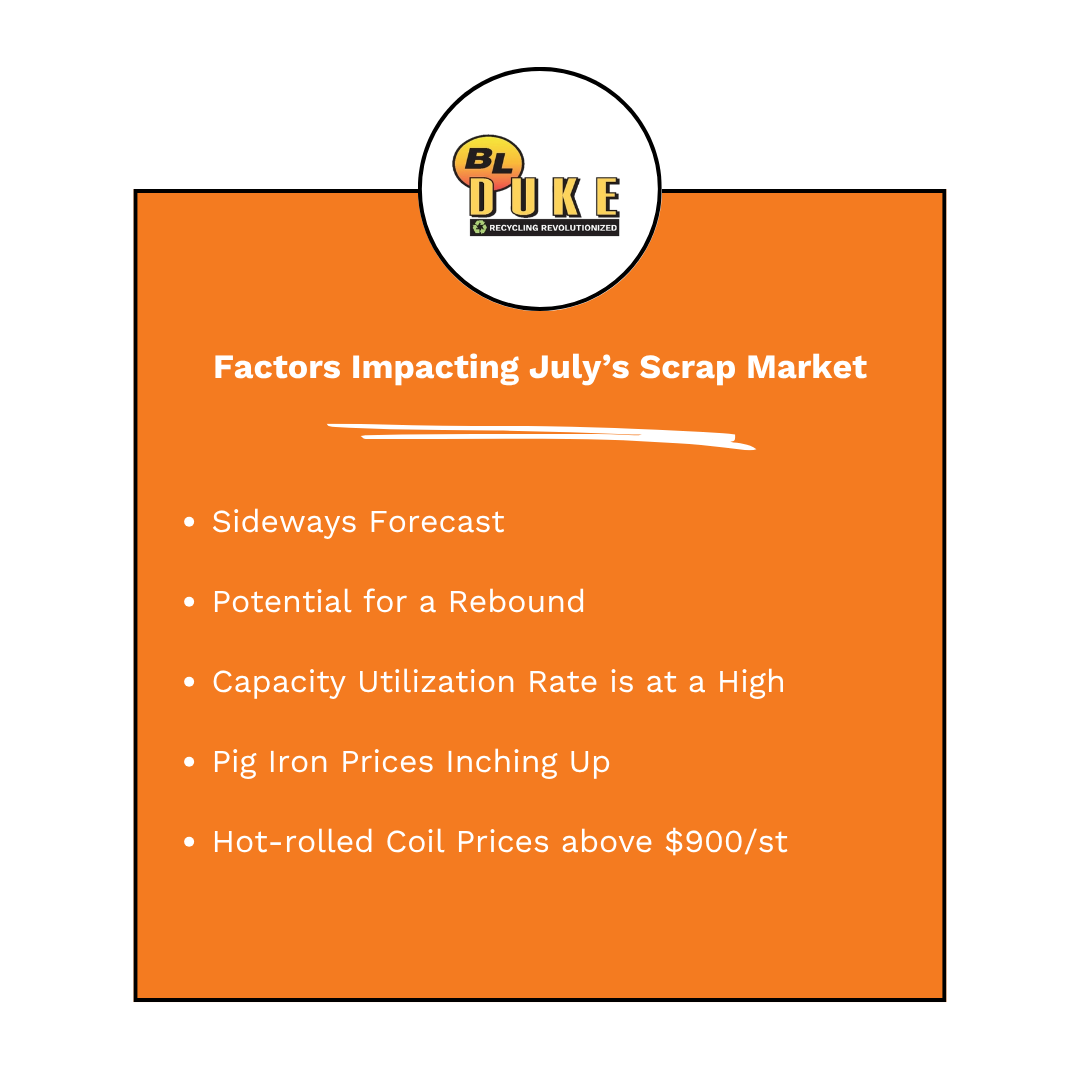

As we move into July, the U.S. ferrous scrap market is trending sideways, showing signs of stability despite the typical summer slowdown. Mills are operating at their highest levels of the year, hot roll coil (HRC) prices are trading over $900 per short ton, and pig iron prices are inching up— reinforcing a market that may be steady for now but could strengthen quickly under the right conditions.

Market at a Glance:

Capacity Utilization: U.S. steel mill utilization hit 79.6% in June, up from 76.2% a year ago—the highest level so far in 2025. This rate continues to climb despite 4 new operational mills coming online, including:

SDI Sinton – 3 million tons/year

Nucor Brandenburg – 1.2 million tons/year

Big River 2 – 3 million tons/year

Hybar – 630,000 short tons/year

These additions represent a significant increase in domestic steelmaking capacity, yet utilization remains strong—a bullish signal for scrap demand.

Local Demand: Domestic demand remains strong, particularly for long products like rebar and wire rod, helping support scrap flows.

Pig Iron Trends: Rising pig iron prices are helping support scrap demand and stabilize overall pricing.

HRC Recovery: Hot-rolled coil pricing has bounced back over $900 per short ton, a potentially bullish signal for mill appetite.

While export markets remain quiet and HRC pricing is still finding its footing, the tight supply of shredder feed and busheling is keeping sellers optimistic. Many anticipate a sideways market for July, with an upward shift likely if demand continues to build and mill buying picks up.

What to Watch:

Could global demand—particularly from Turkey or Asia—reignite export interest?

Will scrap inventories remain tight enough to support pricing into August?

With these dynamics at play, we’ll be closely watching how the market unfolds over the next few weeks. A firming trend may not be far off.