The ferrous scrap market came under pressure in October, with prices slipping across most grades. A combination of weaker steel demand, driven by widespread maintenance outages and ongoing supply imbalances, continues to weigh on the market. Stainless steel prices continue to ease as mill demand softens and LME nickel holds steady, while copper is trending near record highs around $5.00 per pound, supported by tightening supply and strong global electrification demand. Aluminum markets, meanwhile, are holding steady, with limited trading activity and smelters attempting to push prices lower amid sluggish demand.

Chicago’s Ferrous Scrap Market

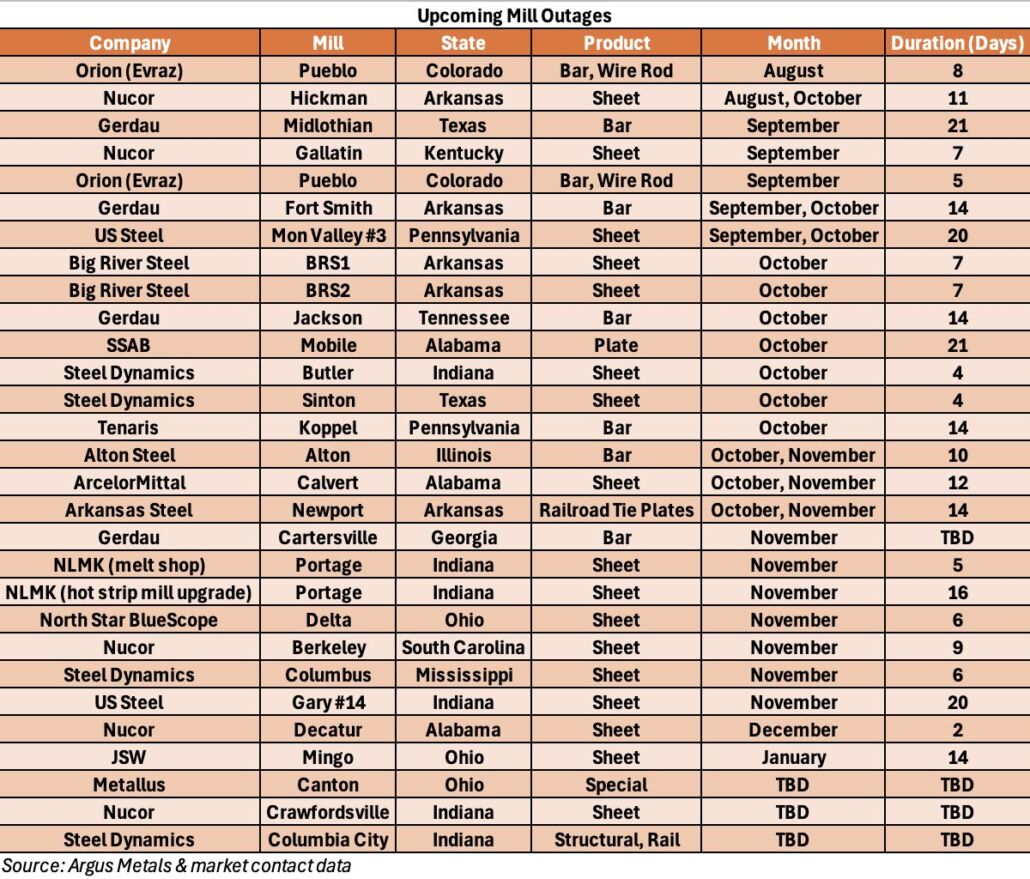

In Chicago, prime grades fell $20 per gross ton, while plate and structural and shredded scrap each dropped $10 per gross ton. Heavy melt and machine shop turnings, however, held steady with September’s prices. Domestic mills continued to scale back buy programs this month amid a challenging demand environment. Twelve planned mill outages, softening hot-rolled coil prices, and ongoing tariff uncertainty all contributed to the decline.

“This month’s market shows how quickly momentum can shift,” said Lou Plucinski, President. “After a stable summer, mill outages and weaker steel prices have flipped the tone, but we’re continuing to work closely with our customers to navigate the volatility.”

Logistical constraints further pressured the market—low river levels and barge delays kept scrap bottled up in Chicago, limiting outbound movement and adding to local supply. At the same time, sluggish export demand offered little relief to counter domestic oversupply. Still, some market participants believe these declines could signal a long-awaited bottom for the remainder of the year.

Chicago’s Non-Ferrous Scrap Market

Stainless Steel:

Prices for 300 series stainless steel grades continue to decline as mill demand softens and LME nickel prices remain flat. With demand weakening further, there’s growing concern that mills may attempt to push prices down even more in the coming weeks. Although the latest round of tariffs announced by the Trump administration doesn’t directly affect stainless steel, any new tariff chatter tends to create distraction and uncertainty. The broader issue remains: tariffs—whether directly related or not—make long-term strategic planning increasingly difficult, as they cloud visibility into where and how companies can source or sell material.

Copper:

Copper prices continue their

Aluminum:

As October begins, aluminum pricing remains stable, with little change and limited trading activity. The secondary aluminum market has been quiet, with smelters attempting to drive prices lower amid slow demand. Meanwhile, a few primary mill-grade categories have seen modest price increases, according to trade publications. Still, sellers are finding it difficult to secure delivery appointments for spot market transactions, further contributing to subdued market conditions.

Celebrating 25 Years of BL Duke

This October, BL Duke proudly celebrates 25 years in business — a milestone that represents more than two decades of growth, innovation, and an unwavering commitment to our customers and community.

What began in 2000 with one truck and a bold vision has evolved into a trusted leader in recycling and logistics. Over the years, BL Duke has continued to challenge the status quo, expanding its operations and introducing solutions that raise the bar for environmental compliance, safety, and service.

As we celebrate this achievement, we’re especially grateful for the relationships that have fueled our growth. Thank you for trusting BL Duke to handle your recycling needs and for being part of our story. Here’s to the next 25 years of progress, innovation, and partnership.

Explore our 25-year journey and see how BL Duke evolved from one truck to a leader in sustainable recycling here.