U.S. ferrous scrap markets are holding on to May’s values, with prices remaining flat across all regions. After two consecutive months of declines, the market appears to have bottomed out—hinting at a potential rebound heading into Q3.

Chicago’s Ferrous Scrap Market

Chicago’s ferrous scrap market held steady in June, indicating that prices may have reached a bottom. Strong order books from domestic steel mills continue to support current price levels. Export demand also remains firm, with offshore pricing now aligned with domestic shred values—prompting East Coast flows to head overseas and easing pressure on domestic supply. The recent announcement of increased steel tariffs has drawn industry-wide attention. While the tariffs haven’t impacted June pricing, they may become a more significant factor in the months ahead.

“June’s sideways market signals we may have finally hit bottom,” said Lou Plucinski, President. “Busheling futures are up, mill demand is strong, and export flows are healthy—market fundamentals are clearly beginning to improve.”

Industry Developments:

Nippon Steel’s acquisition of U.S. Steel is widely viewed as a positive development for the scrap industry. Historically, U.S. Steel has been the only major domestic mill not vertically integrated with a scrap company. By entering the U.S. market, Nippon not only expands its global footprint—already established in Japan, Southeast Asia, and India—but also helps preserve competition among steelmakers sourcing scrap. This is critical for maintaining market balance and protecting competitive scrap pricing.

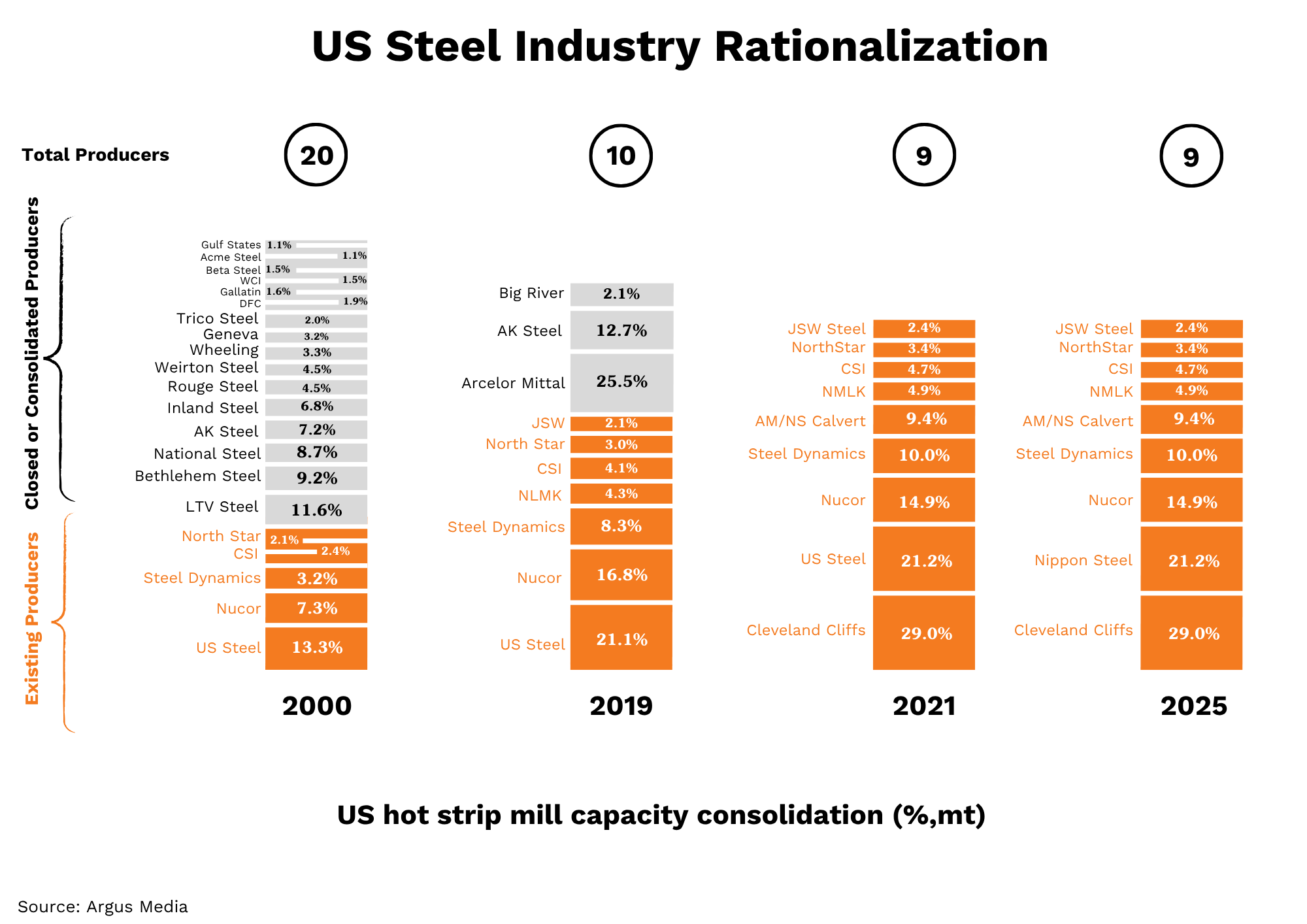

The acquisition positions Nippon to become one of the world’s largest steel producers, with combined output reaching 86 million metric tons per year—and an ambitious goal of 100 million tons annually. It also marks a major shift in the U.S. steel industry, which has experienced significant consolidation over the past two decades. Today, fewer than half of the steel mills operating in 2000 remain in business.

Prior to Nippon’s successful bid, Cleveland-Cliffs was considered the frontrunner. Had that deal gone through, Cliffs would have controlled approximately 50% of U.S. hot strip capacity—raising concerns over further concentration and diminished competition in the domestic steel market.