The ferrous scrap market remained grounded in November, with pricing holding steady and early signs of strength emerging across key sectors. Rising HRC prices, tighter shred supply, and modest export gains are supporting stability as most mill outages have passed. The stainless market mirrors this tone, showing cautious optimism heading into 2026 despite stagnant nickel and tariff uncertainty. Meanwhile, copper and aluminum remain bright spots—both supported by tight supply, improved global sentiment, and easing U.S.–China trade tensions—reinforcing expectations that overall market stability is on the horizon for 2026.

Chicago’s Ferrous Scrap Market

In Chicago, prices held flat across all grades in November, confirming that the market likely found its floor in October. Rising hot-rolled coil (HRC) prices, modest export gains, and tighter shred supply are helping to support current levels, while ongoing mill outages and tariff uncertainty remain limiting factors. Looking ahead, market stability appears to be on the horizon as fundamentals strengthen heading into 2026.

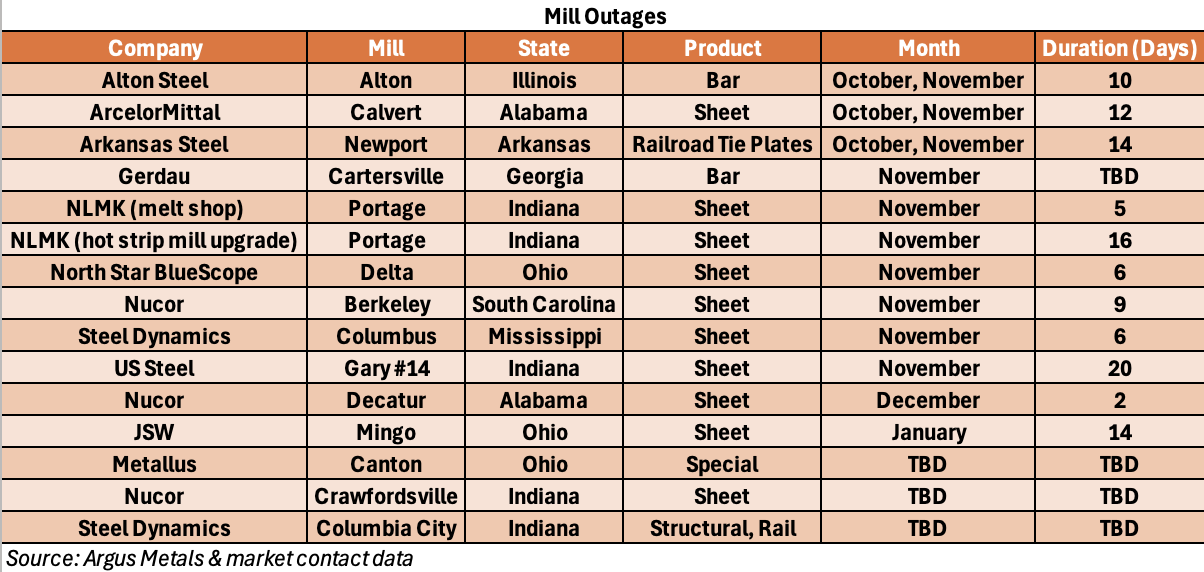

Increasing HRC prices are signaling improving sentiment across the steel sector. After bottoming out earlier this fall, coil prices have begun to firm as mills work through inventories and book steadier orders into the new year. The majority of planned mill outages took place in October, allowing for more consistent melt schedules and scrap demand in November. Together, these factors suggest that pricing stability is taking hold, setting the stage for a more balanced market as we move into 2026.

“After months of downward pressure, we’re finally seeing the market stabilize,” said Lou Plucinski, President. “While prices aren’t climbing yet, there’s more balance between supply and demand — and that’s the foundation for strength heading into 2026.”

Chicago’s Non-Ferrous Scrap Market

Stainless Steel

As we move into November, 304 stainless steel scrap prices have edged down slightly due to stagnant LME Nickel pricing and continued weakness in mill demand. Ferritic (400 series) scrap prices remain flat, with mills and smelters purchasing only what’s needed to fulfill year-end commitments. While sentiment is low, there’s cautious optimism that conditions may improve as 2026 approaches. Although the stainless steel sector hasn’t been directly impacted by the Trump administration’s newly announced tariffs, the broader uncertainty surrounding trade policy continues to complicate long-term planning.

Copper

Copper prices pulled back slightly last week but remain strong overall, up approximately 5.3% month-over-month and nearly 18% year-over-year. The long-term outlook remains bullish, driven by tight global supply and rising demand from sectors like renewables, EVs, infrastructure, and decarbonization initiatives. Supply growth is lagging due to delays in new mine and concentrate output, suggesting a potential shift toward deficit in 2026.

Key market factors to watch heading into 2026 include:

1. Supply disruptions (notably in Chile, Congo, and Indonesia) and how quickly new mine capacity ramps up.

2. China’s demand across industrial, construction, and EV sectors, and the impact of stimulus efforts.

3. Inventory levels and pricing spreads between COMEX and LME.

4. Trade and tariff policy shifts, particularly as global price divergence may widen further.

Aluminum

Primary, mill-grade aluminum scrap  has surged to its highest levels since May 2022, fueled by tightening supply in China and improved demand sentiment following a recent easing in U.S.–China trade tensions. LME aluminum climbed as much as 1.3% to $2,920/MT ($1.3248/lb.), and rose more than 7% in October, marking its best monthly performance in over a year. Market optimism is being supported by China’s state-imposed production caps and recovering demand from construction and consumer goods. The recent trade truce between the U.S. and China has also removed a key layer of uncertainty, although both sides have agreed to revisit several unresolved issues in 2026.

has surged to its highest levels since May 2022, fueled by tightening supply in China and improved demand sentiment following a recent easing in U.S.–China trade tensions. LME aluminum climbed as much as 1.3% to $2,920/MT ($1.3248/lb.), and rose more than 7% in October, marking its best monthly performance in over a year. Market optimism is being supported by China’s state-imposed production caps and recovering demand from construction and consumer goods. The recent trade truce between the U.S. and China has also removed a key layer of uncertainty, although both sides have agreed to revisit several unresolved issues in 2026.

As the year winds down, we want to extend our gratitude to our customers and partners for their continued trust and collaboration. Wishing you and your families a wonderful Thanksgiving and a strong start to the year ahead.