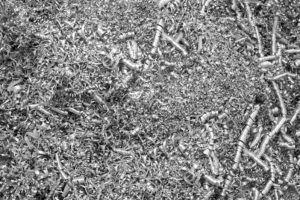

Ferrous scrap prices continued cruising along in August, settling mostly sideways for the fourth consecutive month. The only change was in machine shop turnings and cast iron borings from July. This continued price pause comes amid ongoing tariff uncertainty, but several indicators suggest the market is setting up for a stronger Q4. Stainless steel scrap remains stable, aluminum activity has been sluggish through the summer, and the copper market is facing new uncertainty following the announcement of fresh domestic sales mandates.

Chicago’s Ferrous Scrap Market

While machine shop turnings and cast iron borings saw a $20 per gross ton bump, all other prices remained unchanged for the fourth consecutive month in August. On July 31, just hours before a 50% tariff on Brazilian pig iron was set to take effect, President Trump announced an exemption for both pig iron and iron ore pellets. The move removed what many expected to be a major catalyst for higher pricing this month.

“Scrap demand was strong heading into August, but when President Trump spared Brazilian pig iron and iron ore pellets, it gave steel mills exactly what they needed to suppress scrap prices,” states Lou Plucinski, President. “The threat of mills substituting pig iron with busheling—and the added demand that would’ve created—disappeared overnight. Mills used that shift as leverage to hold pricing flat.”

One development to watch going forward is the increase in tariffs on Canadian steel imports—now set at 35% as of August 1. The U.S. imports roughly 2 million tons of steel each month, with Canada supplying nearly a quarter of that volume. If the 35% tariff remains in place, it could reduce import availability, push more orders to domestic mills, and lead to increased melt activity. While the impact on scrap demand may not be immediate, it could drive stronger demand for prime grades like busheling and low-copper shred later in the year.

At the same time, domestic scrap supply remains tight in key regions—particularly for obsolete grades and steel turnings – while prime grades and shred are still widely available. Long product demand continues to show strength, with Gerdau recently announcing a $60/ton increase on rebar. That momentum, combined with tight supply and ongoing trade policy shifts, supports the idea that the market could begin to strengthen as we head toward year-end.

At the same time, domestic scrap supply remains tight in key regions—particularly for obsolete grades and steel turnings – while prime grades and shred are still widely available. Long product demand continues to show strength, with Gerdau recently announcing a $60/ton increase on rebar. That momentum, combined with tight supply and ongoing trade policy shifts, supports the idea that the market could begin to strengthen as we head toward year-end.

Even with mills carrying adequate inventories for now, increased inquiries and activity around premium grades suggest many are preparing for a shift. If steel trade policy continues to tighten and mill buying picks up, the recent trend of flat pricing may not last much longer.

Chicago’s Non-Ferrous Scrap Market

On July 31st, it was announced that copper scrap would be excluded from U.S. tariffs—though with specific conditions. Under the new rules, 25% of high-grade copper scrap produced in the U.S. must be sold domestically. Lower-grade copper scrap will also face a 25% domestic sale requirement, increasing to 30% in 2028 and 40% in 2029. U.S. suppliers believe the domestic market can easily absorb this volume, as roughly 70% of high-grade copper is already sold within the U.S. This development is expected to encourage a return to Comex-based purchasing. However, uncertainty remains around how “high-quality scrap” will be defined and how the 25% mandate will be enforced.

On July 31st, it was announced that copper scrap would be excluded from U.S. tariffs—though with specific conditions. Under the new rules, 25% of high-grade copper scrap produced in the U.S. must be sold domestically. Lower-grade copper scrap will also face a 25% domestic sale requirement, increasing to 30% in 2028 and 40% in 2029. U.S. suppliers believe the domestic market can easily absorb this volume, as roughly 70% of high-grade copper is already sold within the U.S. This development is expected to encourage a return to Comex-based purchasing. However, uncertainty remains around how “high-quality scrap” will be defined and how the 25% mandate will be enforced.

The stainless steel scrap market continues to hold steady, much like it has throughout 2025. LME nickel prices have dipped slightly and are now trading below $6.70/lb. Purchase prices for 304 and 316 scrap remain flat, with seasonal slowdowns still limiting activity.

In the U.S. aluminum market, summer remains sluggish. A few primary (new production) scrap grades are fetching slightly higher prices domestically, but extended lead times—currently 6 to 7 weeks out—are dampening enthusiasm. Secondary (post-consumer) aluminum scrap is trading flat month-over-month, with smelter buyers reporting soft sales due to the ongoing seasonal slowdown. Meanwhile, LME aluminum prices have turned bearish, catching the attention of overseas buyers and raising concerns of a potential drop in scrap prices in the coming days.

In the U.S. aluminum market, summer remains sluggish. A few primary (new production) scrap grades are fetching slightly higher prices domestically, but extended lead times—currently 6 to 7 weeks out—are dampening enthusiasm. Secondary (post-consumer) aluminum scrap is trading flat month-over-month, with smelter buyers reporting soft sales due to the ongoing seasonal slowdown. Meanwhile, LME aluminum prices have turned bearish, catching the attention of overseas buyers and raising concerns of a potential drop in scrap prices in the coming days.