In September, ferrous scrap prices are cooling down – with prime grades decreasing for the first time since May. Cut grades and steel turnings remained unchanged from August’s pricing. Stainless steel scrap pricing remains flat heading into September, with no significant movement expected until LME nickel rebounds and demand improves. Primary aluminum scrap remains elevated, while secondary grades like old cast and painted siding continue to trade flat amid weak demand. The copper market has softened after a recent high, with uncertainty around Chinese demand and global economic conditions keeping prices volatile.

Chicago’s Ferrous Scrap Market

In September, prime grades decreased $20 per gross ton, while cut grades and steel turnings saw no change in price. Domestic steel mills have scaled back buy programs, putting downward pressure on prime grades. US sellers also reported a rise in end-of-month cancellation notices, reflecting softer appetites at some steelmakers and planned maintenance outages at others. By August 29, at least four major producers had issued blanket cancellations on unshipped scrap orders. Meanwhile, machine-shop turnings remain extremely tight, and supplies of cut grades such as No. 1 heavy melting and plate & structural scrap are also in short supply.

“Demand has softened as mills head into maintenance season,” states Lou Plucinski, President. “With outages across multiple regions and cancellations on unshipped orders, mills have the leverage to push down prime pricing. That said, we continue to see tightness in machine-shop turnings and cut grades, which should help those segments hold steady.”

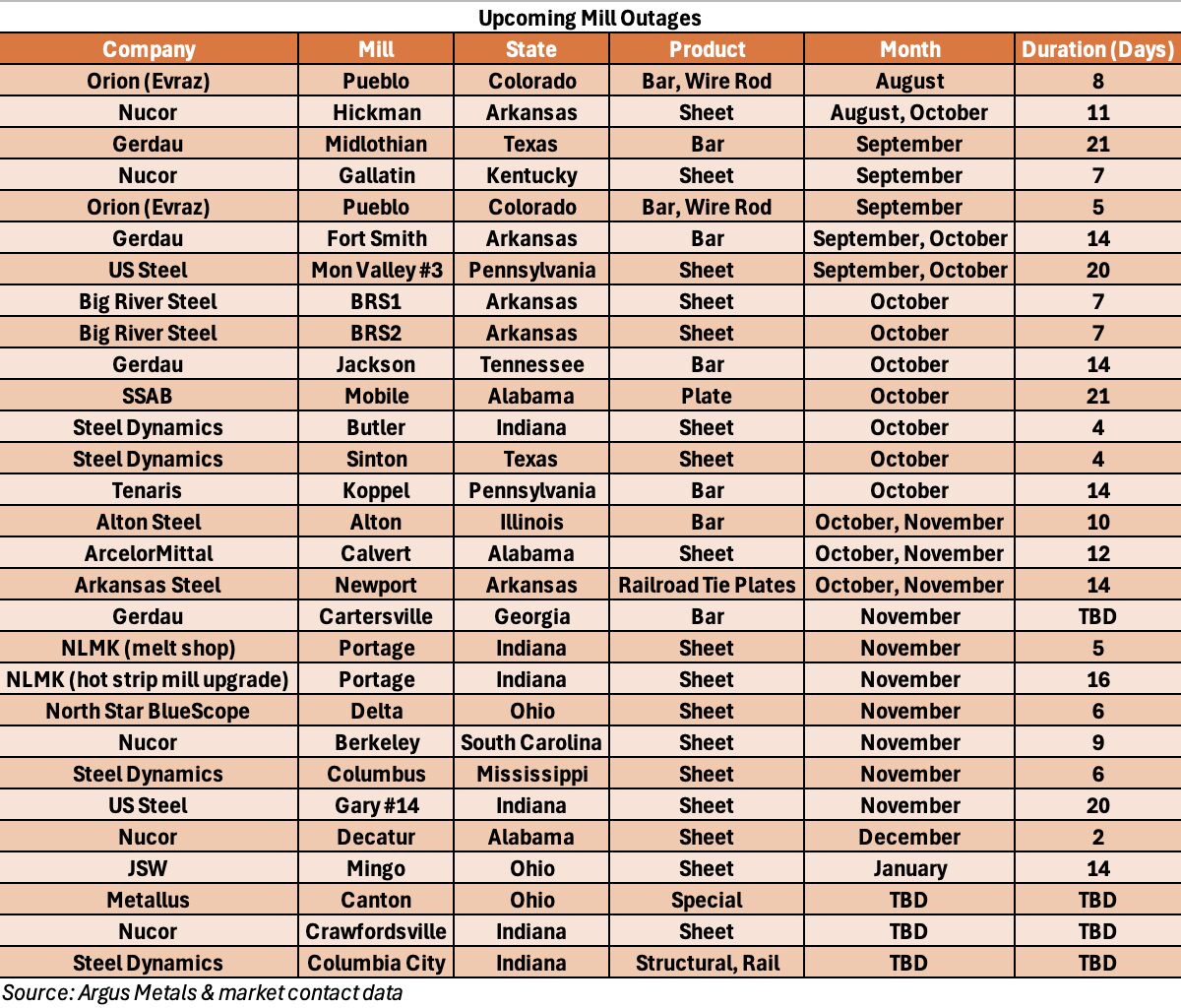

Looking ahead, multiple mill outages are scheduled over the coming months. While these outages may temporarily tighten supply, they also reduce immediate scrap demand, adding another layer of short-term market pressure.

On August 19th, the U.S. government enacted a 50% tariff expansion on 407 steel and aluminum product codes. The sweeping scope covers auto parts, transformers, HVAC equipment, aluminum wire, fasteners, and household appliances. These tariffs are reshaping import economics, which could ripple into both domestic supply chains and global demand flows. While the immediate effect on scrap demand is muted, longer-term shifts in manufacturing costs and sourcing strategies may create added uncertainity.

Chicago’s Non-Ferrous Scrap Market

Stainless Steel:

The stainless steel market entered September much like it did in August—hopeful for a turnaround yet facing the same stagnant reality. Pricing has shown little to no change, as the market continues to tread water. The outlook remains muted: until LME nickel prices see a meaningful rebound and demand improves, stainless steel scrap prices are expected to hold steady at current levels.

Aluminum:

Primary aluminum scrap prices remain elevated, largely due to a sharp 74% drop in P1020 imports to the U.S. since June. This decline follows President Trump’s executive order doubling tariffs on aluminum imports from 25% to 50%. P1020—aluminum ingot with 99.70% purity—is widely used across industrial applications thanks to its strength and durability.

Primary aluminum scrap prices remain elevated, largely due to a sharp 74% drop in P1020 imports to the U.S. since June. This decline follows President Trump’s executive order doubling tariffs on aluminum imports from 25% to 50%. P1020—aluminum ingot with 99.70% purity—is widely used across industrial applications thanks to its strength and durability.

In contrast, the secondary aluminum scrap market remains soft. Older, lower-grade materials like Old Painted Siding, Old Cast, and other contaminated scrap continue to trade flat, reflecting weak demand and minimal spot market activity.

Copper:

Copper prices have retreated after reaching their highest LME levels since March, amid growing uncertainty about Chinese demand. Market sentiment has been swayed by a weakening U.S. dollar and speculation around potential interest rate cuts. While some remain optimistic due to tightening global supply and stable consumption, others point to China’s slowing industrial activity as a major headwind. For now, the market remains unsettled, with growth in the copper sector likely to be constrained through the remainder of 2025.