During the first week of each month, referred to as “The Buy,” our team negotiates with steel mills to secure purchase orders for all ferrous grades. The remaining three weeks are then focused on fulfilling these orders. Various factors, including supply and demand, mill outages, export demand, weather conditions, and the availability of freight and cost, impact these negotiations. At BL Duke, we prioritize shipping point pricing and take full advantage of our ability to ship materials via truck, rail, and barge.

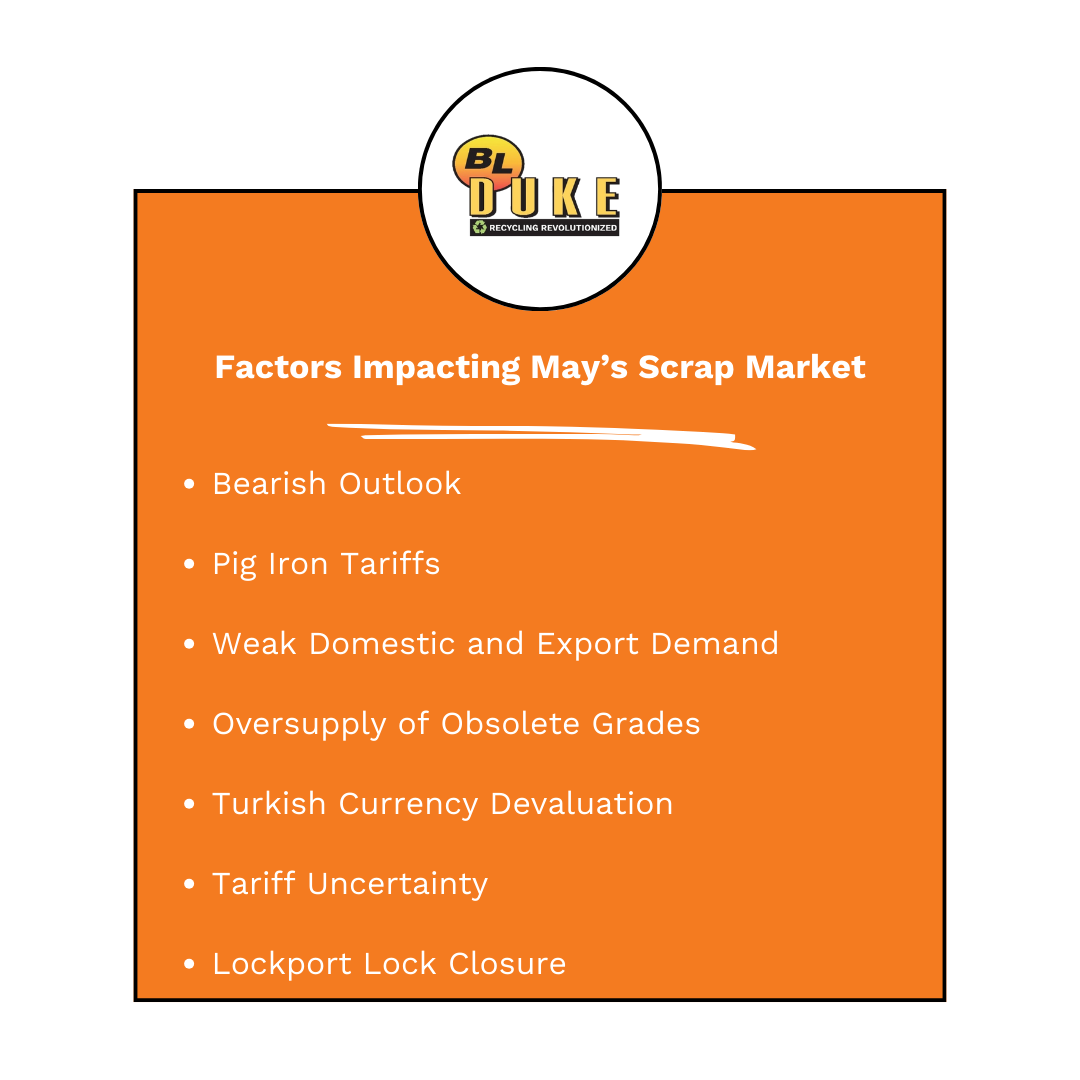

As we move into May, the ferrous scrap metal market remains under pressure driven by a combination of soft demand, currency shifts, transportation disruptions, and tariff-related volatility. While some stability is expected in prime grades, the overall market environment remains challenging.

Several key factors are shaping the outlook:

-

Tariffs on Pig Iron: Pig iron, a key scrap substitute, is currently trading at $522/GT after factoring in a 10% tariff. Meanwhile, Chicago busheling prices are listed at $460/GT. This pricing dynamic suggests that prime grades are expected to hold up better than obsolete grades as we move into May.

-

Weak Demand: Domestic and export markets continue to show signs of weakness, with soft mill order books putting downward pressure on pricing across most scrap categories.

-

Turkish Currency Devaluation: Since 2020, the Turkish Lira has declined approximately 80% against the U.S. dollar, significantly reducing Turkish mills’ purchasing power for U.S. scrap. This has further weighed on export activity and pricing.

-

Oversupply of Obsolete Grades: As a net exporter of recycled materials, the U.S. is now seeing more obsolete grades remaining domestically due to softer export markets, creating an oversupply situation and adding pressure to already weak prices.

-

Tariff Uncertainty: The announcement of new tariffs—and uncertainty around potential retaliation—continues to add volatility to the market, making forecasting and pricing increasingly difficult.

-

River Closure: The ongoing closure of the Lockport Lock is another complicating factor, disrupting river transportation flows. Although the reopening is now scheduled for May 6th, the prolonged shutdown has already added logistical challenges to scrap movements.